Blackfinch Adapt IHT Service

Business Relief-qualifying investments in as little as two years - insured option available

What is the Adapt IHT Service?

With more estates paying Inheritance Tax (IHT) every year, finding flexible ways to help clients mitigate an IHT bill, without losing control over their wealth, can be a challenge. Our flagship IHT solution uses Business Relief (BR) for a swifter route to IHT exemption. Clients benefit from owning a portfolio of BR-qualifying investments across seven distinct asset classes: renewable energy, asset-backed lending, property development finance, forestry, leisure, home building and UK private asset opportunities.

Invest with Life Cover

The Blackfinch Adapt IHT Insured Service is an insured option on our existing Adapt IHT Service designed for clients who want added peace of mind during the two-year BR-qualifying period. It offers the same BR-qualifying opportunities as our standard Adapt IHT Service, with the option to insure either 20% or 40% of the initial investment amount.

Our insured service offers a simple way to add reassurance to IHT planning by helping investors protect family wealth. And with insurance cover of up to £400,000, it suits those looking to make confident and meaningful estate planning decisions.

More detailed information on insurance cover options is available in the brochure.

See the key details for our insured option below:

Life cover for the first two years, helping to protect against IHT if the investor passes away in the BR qualifying period.

Investors can choose to cover either 20% or 40% of their initial investment amount, up to a maximum pay out of £400,000.

Two simple premiums, with the first taken upfront from the subscription amount and the second automatically deducted from the investment a year later.

Immediate cover from the point that the premium is paid and shares are allotted.

Key Benefits

Speed

After two years of being invested, your shares should benefit from up to 100% IHT relief* as long as they were held at the time of death. If your shares replaced other shares that were BR qualifying, the relief could start sooner. The optional insured service means investors could receive coverage from the point the premiums are paid and the shares are allocated.

Value

The service targets a net annual return of 3% - 5%. There’s no annual management fee and the exit dealing fee is waived in the event of investor death. Where an investor dies within two years following share allotment, any up-front dealing fees, will be refunded.

Control

Clients retain access to, and control of, their wealth. They can take regular payments, or make full or partial withdrawals if their circumstances change.**

For investors in our Adapt IHT Insured Service premiums are fixed by age band and won’t increase, if clients age into a new bracket.

* For more information on the new rules that take effect from April 2026, please refer to the Blackfinch Guide to Business Relief.

** Any withdrawals from the service will no longer qualify for IHT relief and are subject to available liquidity.

Defaqto Diamond Rated Portfolio

We’re pleased to announce that we have received a 5 Star Rating and a 5 Diamond Rating for Unlisted BR Service from Defaqto, the UK's most trusted source of financial product intelligence. To find out more, please get in touch.

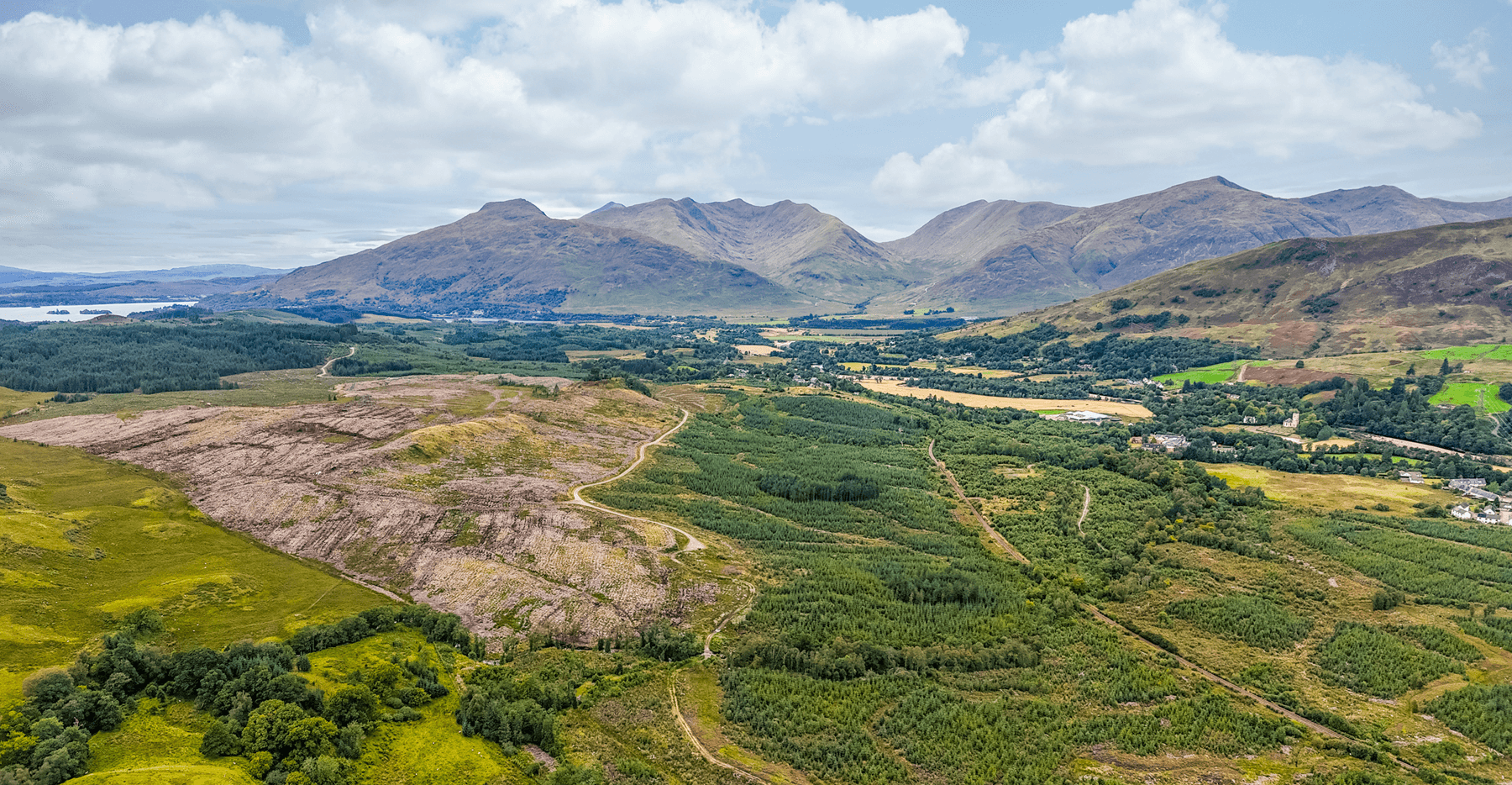

See Our Forestry Strategy in Action

For Blackfinch, forestry investing involves acquiring a portfolio of woodland across the UK, in which the trees will vary in their degree of maturity. The woodlands we look to acquire contain a mixture of tree varieties, all of which are capable of fulfilling the commercial demand for UK timber.

Trees generally grow for 30-40 years before being harvested, so forests that vary in maturity mean a consistent cash flow over different periods. When you harvest, you have an obligation to restock.

In this video of one of our forestry assets, you can see the different stages of growth, harvesting and replanting in action.

One BR-qualifying portfolio with a broad range of investments, including:

Renewable Investments

We invest in the proven technology of solar and wind energy, with over 70 assets nationwide. Investments can deliver stable predictable revenues. Many projects benefit from prior government subsidies. We also now invest in subsidy-free developments, acquire subsidised operational projects and use Power Purchase Agreements with strong counterparts.

Asset-Backed Lending

We provide asset-backed finance for business and property deals typically in the region of £0.5m-£25m. Loans target a conservative loan-to-value ratio and are fully secured. We focus on transactions in established sectors with reputable partners.

Property Development Finance

We work closely with property developers around the UK, providing finance ranging from £1m-£25m. Loans are fully-secured and have a conservative loan to value ratio. Loans are typically for new build projects, redevelopments and major renovation works. We invest across sectors and regions, in everything from eco-flats to care homes.

Forestry

We are growing a portfolio of woodland across the UK, which will vary in their degree of maturity. The woodlands will contain a mixture of tree varieties, all of which will fulfil the commercial demand for UK timber. The woodlands will be responsibly managed, to support regional biodiversity and compliance with Forestry Commission standards for sustainability.

Leisure

An asset class targeting hotel and tourism accommodation projects across the UK. We invest through the build and fit-out phases, converting developments into fully operational, income-generating sites. By owning these tangible assets and partnering with leading operators, this offers a complimentary addition to our group activities.

Home Building

Building on our extensive experience of lending against property developments, we have expanded our property team to include construction specialists who will lead on house building developments around the UK. Once completed, new homes will be sold on to residential buyers.

UK Private Asset Opportunities

We are pursuing a number of higher growth opportunities in UK businesses. Deployment in this asset class will not exceed 5% of the portfolio at any one time. This asset class will explore multiple and varied sectors and industries.

To see the behind the scenes of Renewable Energy, Property and Forestry Investing, take a look at the short videos below:

Adapt IHT Service: Tax Benefits

Investments in the Adapt IHT Service can qualify for up to 100% relief from IHT after just two years, provided it is still held at the time of death.

In contrast, gift and trust arrangements can take up to seven years to achieve full exemption.

Benefits of tax-efficient investments are subject to change and personal circumstances